What is these days? We’re hearing that the Western world’s

financial system is about to implode because of Cyprus, that no one’s bank

savings are safe because of Cyprus, that the EU will fall because of Cyprus,

and that Merkel is the devil because of Cyprus. Okay, I’m exaggerating—Germany’s

Prime Minister was vilified long before Cyprus.

For those of you locked in your room for the past couple of weeks

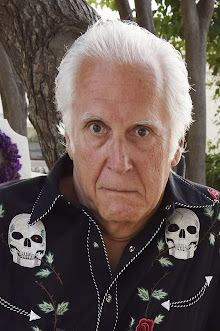

playing the latest version of “Call of Duty,” let me take some time, as Fagan

sang in Oliver, “reviewing the situation.”

|

| Ron Moody as Fagan |

Cyprus is an eastern Mediterranean island about one and

one-half times the size of the U.S. state of Delaware, with a total population

of a bit more than a million. Since 1974

it’s been divided into a Turkish occupied north and the Greek-speaking Republic

of Cyprus to the south. It is the south

that’s a member of the EU, not a NATO member, on the Euro, the subject of

current financial concern, and what I’m referring to as “Cyprus” in this post.

|

| Divided Cyprus |

It was no secret that after the breakup of the Soviet Union Cyprus

became the place of choice for many former Soviets looking for a safe haven in

which to bank their money, and that there’s broad speculation over the sources

of those depositors’ funds and the uses to which they’ve been put [think Cold

War thriller scenarios].

But Cyprus gladly accepted its new-found windfall (its banks

grew to hold eight times the nation’s gross domestic product (GDP)) and the

influx of Russian millionaires—and billionaires—buying up many of the island’s

most expensive residential properties.

The Cyprus economy cruised along quite nicely, doing relatively

well even during the early years of the worldwide recession. Then came the Greek bond crisis, and the

bottom fell out for Cypriot banks. They were heavily—some say

disproportionately or even speculatively— invested in Greek government

debt. The Cypriot government

nationalized one bank to avoid its collapse and borrowed heavily to support its

system, including loans from Russia, some at less than prevailing interest

rates but with maturity dates just a few years away.

None of that, though, was enough, and in order to save its

banking system Cyprus needed an infusion of 16 billion euros, roughly equivalent

to its GDP. Enter the Troika (IMF,

European Central Bank and EU) offering to loan 10 billion euros if the Cypriot government

came up with an additional 5.8 billion euros and agreed to other terms intended

to stabilize its banking system and (hopefully) hasten its return to fiscal

health.

What sent prophets of doom to the ramparts was the proposal put

forth by the newly elected Cypriot President (in consultation with the Troika)

for raising that additional 5.8 billion: Impose a one time “tax” on depositors’

accounts—9.9% on bank accounts above 100,000 euros and 6.75% on the smaller

ones.

All hell broke loose, with screaming demonstrations, runs on

ATM machines (the banks were and remain closed), and the Cypriot Parliament ultimately

and unanimously voting down the proposal.

The question is, “Now what?” Either Cyprus doesn’t get the

money it needs or it does. If it doesn’t,

the country’s banks fail, with inevitable widespread pain to many. Just how far and deep that pain will spread is

a matter of economists’ speculation—a notoriously inaccurate conjurers’ device.

All I can say is we shall see, but it seems hard to imagine

that in light of the many unique factors surrounding the Cyprus crisis that the

world will plunge into a “Great Depression” or the European Union will fall. And that’s not just because of the relatively

small size of the Cyprus economy. In

fact, some wags say that if Cyprus refuses to accept the Troika’s terms, its

small size makes it a “manageable” example to other struggling EU nations of

what will happen to your country if you refuse to be “realistic.”

Frankly, it appears that many of those “unique factors” are

what led to the incendiary bank account “tax” proposal in the first place. For example: Many of the largest account

holders are foreigners, mainly Russian, so the “tax” was seen as a way of

bringing substantial funds into the Cypriot economy from foreigners, rather

than taking it all from Cypriots though such means such as reducing pensions; foreign

investors, mainly Russians, have long known of the precarious situation facing

Cyprus’ banks yet chose to keep their money there; and Cyprus bank accounts

paid 5% interest (three to four times what U.S. banks paid) and in post-Madoff times

anyone expecting that sort of out of whack interest return had to realize there

was a gamble involved, and losing less than 10% was not that bad a haircut

under the circumstances.

The big miscalculation was “taxing” the small account holders

(rather than taking a bit more from the larger accounts to come up with the 5.8

billion) who believed the government had promised to protect accounts of up to

100,000 euros. It was a PR disaster, even

though at the time it certainly must have seemed a brilliant solution to some

Cypriot politicians. After all, during

the last parliamentary election in neighboring Greece one party leader advocated

imposing such a “tax” on every bank account in excess of 20,000 euros as a

means for getting Greece out of its mess, and his party garnered the second

most votes.

Bottom line: It wasn’t a smart move. BUT at least one behind the scene’s player

has carefully positioned itself to take advantage of the unfolding situation.

For Russia it looks to be a win-win situation. If the Troika gives Cyrus the money on terms

acceptable to the Cypriot people, other EU countries in need (Greece, Spain,

Portugal, Italy, Ireland, and to be continued) will likely stiffen resistance

to the popularly unpopular conditions of their Troika loans…drawing out the

“euro crisis.”

If the Troika doesn’t deliver and Cyprus crashes, it gives

credence to Russia’s message for the former Soviet Satellites now part of the

EU or wishing to be (something Putin has never forgiven the West for encouraging)

that they cannot trust the West to be there when they need them most.

But no matter what the Troika does, Russia now has a far better shot at getting

a piece of something it really wants: Cyprus’ recently discovered, vast

offshore natural gas deposits. That

discovery put Cyprus in conflict with Turkey, into an alliance with Israel, and

in future competition with Europe’s primary supplier of natural gas, Russia’s

Gazprom. A financially strapped Cyprus,

owing billions to Russia, and needing billions more to develop its gas reserves,

this week sent its Finance and Energy ministers to Moscow—and the Church of

Cyprus announced its willingness to post its wealth as collateral.

What sort of bargain do you think the Russians will

drive? To some extent it depends on

whether the Troika or Cyprus blinks first. And, of course, how belligerent Turkey is prepared to become. But either way the Russians undoubtedly see themselves as winners. After all, let’s not forget that much

of what happened to Cyprus in the past was the result of Cold War concerns by

the West over the island’s potential alliance with the Soviets. Now it’s only the Russians. And they are coming.

[Update: As of late Friday Cyprus still had no fixed plan, but looks to be making deal with the Troika that puts no tax on small accounts but a whooping 22-25% hit on accounts above 100,000 Euros. Russia’s position: Sorry, no help now, let’s first see what kind of deal you can make with the Troika, then we’ll talk. The dance continues.]

[Update: As of late Friday Cyprus still had no fixed plan, but looks to be making deal with the Troika that puts no tax on small accounts but a whooping 22-25% hit on accounts above 100,000 Euros. Russia’s position: Sorry, no help now, let’s first see what kind of deal you can make with the Troika, then we’ll talk. The dance continues.]

If that sort of modern day Russian intrigue seems fitting

for a novel, you’ll find more on September 3rd when MYKONOS AFTER MIDNIGHT is

released by Poisoned Pen Press.

Jeff—Saturday

As always, great insight into a place many journalists have just discovered. I am a great believer in the freedom of the press - but the press continues to exacerbate situations like this.

ReplyDeleteYou're preaching to the choir on that point, my friend. The headlines drive the crowds to positions that make absolutely no sense for their long term interests...just momentary ratings for the visiting networks.

ReplyDeleteThank you for giving clarity to this citizen of New York City and avid reader of the New York Times! Thelma Straw in Manhattan

ReplyDeleteMy pleasure, fellow avid NYC NYT reader and possessor of my beloved mother's first name!

DeleteInteresting to be watching this unfold, and how it will affect Greece, too. As usual, the facts are muddled by the media, who display comments and protests by the masses, while at the same time proclaiming the government tax on bank accounts as the basic way forward. There's the rub: If you take it all and blend at high speed, you might get something closer to the truth. Hearts go out to the little guys, the simple Cypriot citizen who will suffer the most, no matter what decision is taken.

ReplyDeleteAs for Mykonos After Midnight, making us wait until September 3rd is just torture! Looking forward to it, though.

So true, Jody. Far too much of the media covers events in a way intended to garner market share rather than bring a sensible perspective to a situation. As always, the "little guys" will suffer most, even if their bank accounts are spared.

DeleteThere is simply far too much of interest in play on Cyprus to private and public world powers for the intrigues to end with a "bailout solution." That's just the way it's always been there, and for that matter, for its part of the world, e.g., Israel's apology to Turkey.

Very interesting report, Jeffrey. I personally think the tax on bank accounts is outrageous. That money has already been taxes (although some of the Russian gazillionaires may have found graceful side-steps), and I think taxing it further amounts to outright theft. Here's a bank for your convenience and safety, guaranteed by your government, oh, and we're taking one-fifth of your money.

ReplyDeleteAlso interesting that the people see Merkel as the villain rather than the gormless idiots who have been mismanaging the country. I don't think it's ENTIRELY unreasonable, if you're offering a loan of some ten billion Euros, to stipulate that Cyprus has to come up with some of the rescue money.

And people will jump on me for this, but I know several countries (Thailand, for one) where Russians have become prominent residents, and it's hard to say they tend to add much to the mix, wherever they are. It may be that many of the Russians who can afford to become expatriots are the "wrong" kind of Russiansm with both thumbs in the enormous Russian shadow economy, but they don't bring much to the party, other than money, most places they go, and crime always seems to rise with their arrival.

People may yell at me now,

ARGHH, OWWWW, YEEEH, GOOSSSSHH, GEE WILLY!!!

ReplyDeleteWhew, I'm exhausted. Hope that was enough yelling, Tim, because now I need a Schvitz bath. Whoops, that's a Turkish-Russian invention, and rather insensitive of me to raise considering the subject of this post. But, yes, the Russians do have a reputation along the lines you describe--one that I'm shamelessly exploiting in my new book :)

Thank you for the help in understanding what I really don't understand. I'll just wait for Mykonos After Midnight. These days, I like my history with some story, not what the networks decide is important.

ReplyDeleteJeff, I read this post twice. Great insight into a complicated situation.

ReplyDeleteThank you, my friend Charlotte. That's great praise indeed coming from you!

ReplyDeleteHello There,

ReplyDeleteI just wanted to see if you were currently interested in additional guest bloggers for your blog site.

I see that you've accepted some guest posters in the past - are there any specific guidelines you need me to follow while making submissions?

If you're open to submissions, whom would I need to send them to?

I'm eager to send some contributions to your blog and think that I can cover some interesting topics.

Thanks for your time,

Tess

Cyprus’s most popular export ever has been its positive propaganda; but unfortunately the island’s own people and government began to believe the hype and ‘accept’ that the nation was immune to the likes of global economic, political and even legal realities

ReplyDeleteA very interesting observation. Thank you!

ReplyDelete