I received an email this week that made me think about assets.

My introduction to assets was as a teenager, particularly to physical assets, but not of the gold bar variety. For me, such assets were to be admired at a distance, but not touched. Sort of like the Mona Lisa. But even as a teenager, I knew that at least the Leonardo da Vinci painting was a real asset that would appreciate over time.

My father was a businessman and introduced me to the stock market in South Africa. I remember well my first investment – one hundred shares at about two rand each. That was a fortune since my monthly salary as a computer programmer was about R200 a month.

I learnt several lessons from that adventure. The first was that I found myself fretting about the investment, checking each day’s newspaper to see whether I was enhancing my net asset worth. Or not. I realised early on that for me the pleasure of gains did not compensate for the anxiety I felt when the share dipped by a cent or two.

The second lesson I learnt was that I was fascinated by what made the share price move – forces that I did not understand at all. Good news would be reported: sometimes the share price would rise, sometimes it would fall. Why the difference? My enquiring mind needed to know. Sometimes there was no news at all – at least discernible to me – and the price would fluctuate. Bizarre.

I don’t remember whether I made or lost money on that terrifying first stock trade, but it left its mark. I was hooked; I was afraid; but I was determined not to live in anxiety. That was when I started developing my emotional strategy for investing. Instead of hanging on every move of the market and being a worrywart, I decided it made more sense to write any investment down to zero the moment I bought it. Then whatever value it had was profit. I became a happy investor.

I learnt a third lesson at about the same time, namely that I had a need to enjoy my investments, or at least some of them, on a day to day basis. A price on the stock-market page of the newspaper wasn’t enough. So, I started reading about South African artists whose painting or sculptures I liked. And when I had saved up some money, I’d head off to an art auction and occasionally found a piece that I could afford. Over time, I acquired some lovely pieces, most of which I still have today.

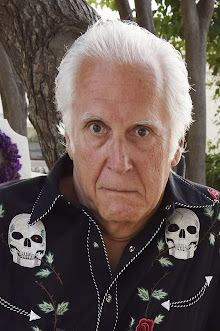

|

| Part of my collection |

There was a fourth lesson wrapped up in this that I didn’t realise for some time. As time passed, I found that I enjoyed interesting pieces of art more than new cars, fine furniture, and fashionable clothing.

Some of the investments I’ve made have been both fun and potentially scary. When I was a grad student at Illinois, a friend and I decided we wanted to explore the world of futures. Being in the Midwest, there was a very active market in corn, soybeans, hogs, and so on. Again, I can’t recall whether we made or lost money, but remember vividly nearly having to take delivery of five contracts of pork bellies. I think that was in the thousands!

|

| One pork belly |

To get back to the email that sparked all these memories. As you can see from the above, I’ve been active in traditional and non-traditional investing. In one instance, I made an investment in one of my hobbies – stamp collecting. The oldest and probably best known stamp dealer in the world is Stanley Gibbons of London which opened its doors in 1865. Many years ago, they had a great rarity for sale. The 1969 British Ships with red funnels omitted. I bought it because there were only two pairs and one single example recorded.

It did go against some of my philosophy since it is stored in Guernsey and not in a frame on my wall.

Back to the email. Last week the world’s rarest stamp went on auction. It is the 1856 British Guiana One-Cent magenta, with its three-masted sailing ship. It sold for $8.3 million and was bought by none other than Stanley Gibbons. You can read the stamp's interesting history here.

|

| THE stamp! |

When I read about this, I was puzzled. Why would a retail outlet like Gibbons buy such a stamp? What are the chances that it could flip it for a profit? I shook my head.

Then I read further and found out that Stanley Gibbons is NOT going to sell it. In its words, it is going to democratise its ownership. What this means is that it is going to sell shares in the stamp and keep it on display in its shop on Strand Street in London.

If it is really going to make this opportunity available to the person on the street, say at £1000 ($1400) per share, each shareholder would have 1/8300th of the stamp. If the anti is upped to £10,000 per share (hardly democratic), you would own 1/830th of the stamp. Either way, you would need a microscope to view your share of this physical asset.

|

| A very enlarged $10,000 share |

My guess, in order to bring owners into the shop, shares will be about £100. This means 83,000 shareholders will own a very, very, very small piece of the stamp. For its annual meeting, Guiana 1856 Ltd. will need an arena bigger than the one Berkshire Hathaway uses.

What an interesting idea.

However, just as I don’t understand cryptocurrencies, I don’t get this. I pass.

I also didn't get it! I also pass!

ReplyDeleteHow has the British Ships stamp done?

Michael, as far as I know, IF I could sell it at catalogue value (another number I don't understand), I would end up with more £s than I started with. However, due to yet another thing I don't understand (exchange rates), I would probably end up with fewer $s. Fortunately, whatever happens, in my mind I make a profit!

DeleteI expect "catalogue" value would be the appraised value of an item. However, if you were to go through a broker of some type, then they're going to take their cut. I know in dealing with some limited edition prints, the dealers generally offer 50% of catalogue value, not very generous. Better to sell on the open market at a discount if possible.

DeleteI own a small piece of Scotland via my purchase of Laphroaig, but I expect it's worth to me is the cost of the pixels it took to say this.

One wonders (as the mind wanders) if some shares (areas of the stamp) are more valuable than others? Is a piece of a mast worth more than the bow sprit? What if your piece is underwater? I think I'm definitely too financially conservative to bring a piece of this home...

ReplyDeleteIf your Gibbons is anything like the $8.3 million stamp,Stan, one thing is true for sure: you're buying the drinks at Bcon. As for the arrangement, it sounds like a traditional sort of "participation" interest in the asset. I'm sure the participation agreement spells out how one can transfer or sell one's interest and how the proceeds will be divided should a decision be made to sell the asset itself. The agreement also likely goes into detail on what fees Gibbons may be entitled to in conjunction with "managing" this undertaking.

ReplyDeleteAre you a lawyer or something, Jeff?

DeleteFormerly a lawyer. Now a something. :)

Delete