Last week I told you about the scallywag Captain John

Lawson, who conned many people into believing he had discovered, in New Guinea,

a Mount Hercules, three thousand feet higher than Mount Everest. Of course, it doesn’t exist. Nor did Captain Lawson apparently,

because no one knows who he was.

|

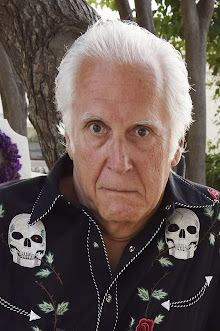

| Alfred William Lawson |

Today I want to introduce another Lawson – in this case

Alfred William Lawson, born in London, England, on March 24, 1869, which he

later claimed was “the most momentous

occurrence since the birth of mankind”. Three weeks later his family moved to Canada and

three years later settled in Detroit.

He was a man of many talents – professional baseball player, publisher,

aviation pioneer, physicist, economist, philosopher, and university president.

He was also a prolific writer, whose output we can all

envy. He wrote a total of about 50

books, mainly about his scientific, philosophical, and economic theories. And, as you will read in my next blog,

he figured out an almost perfect marketing strategy to sell them.

There is so much of interest to report about Lawson that I

may have to write a third Lawson blog to do justice to the breadth of this

man’s expertise.

I have been a fan of Lawson since I learnt about him in the

mid 1970’s from my friend Bob Jacobs with whom I worked at the Aviation

Research Lab at the University of Illinois at Urbana-Champaign. Bob and I, in our spare time as

graduate students, also founded the Numbers Racket, which was the best retail

outlet in the area for hand-held calculators. But that is another story.

In my subsequent reading of some of Lawson’s books and of

biographies of Lawson, I have come to the conclusion that he was fundamentally

influenced by his father, Robert Henry Lawson, who spent decades trying to

perfect a perpetual motion machine.

First, a brief background:

1. Made his Major League Baseball

debut as pitcher for the Boston Beaneaters (!) on May 13, 1890. It appears that after one appearance he

was transferred to the Pittsburgh Alleghenys, for whom he played two games. The rest of his career was in the minor

leagues.

2. When his baseball career started to

fade, he founded and published aviation magazines. This venture showed his character, as he had no publishing

or aviation experience. What’s

more, when Fly magazine came out in

1908, only three people had ever flown in heavier-than-air machines. He went on to also publish Aircraft, a term he trademarked in 1910.

|

| Training aircraft |

3. He founded the Lawson Aircraft

Company, which designed a training aircraft during World War I. The war ended before the plane went

into production. He then turned

his hand to building an aircraft to carry passengers. His plan was to provide passenger service around the

country. In 1919, his 16-seat

airliner flew a 3,000 km from Milwaukee to New York and Washington D.C. and

back. When in Washington, he took

a flight with six senators, the Secretary of War, and several others. His lobbying efforts won him a large

Post Office contract to deliver mail to the country’s major cities.

|

| 16-passenger airliner |

Unfortunately his latest plane,

the L-4, crashed on its maiden flight causing his financial backers to withdraw

their support. Undaunted, he

designed a double-decker, twelve-engine plane capable of carrying 125

passengers. It had sleepers and showers. Unfortunately, the Great Depression thwarted his ideas and his financial

backers again pulled back. (By the

way, he patented the idea of the double-decker vehicle and made some decent

money by selling the rights to bus and train manufacturers.)

|

| Luxurious interior |

He

decided to get out of the aviation business and turned to economics, philosophy,

and education. It is the first of

these I want to tell you about in this blog.

The Great Depression had a big impact on Lawson. It destroyed his aviation dreams, but

also was the catalyst for him to start the Direct Credit Society, which soon

had millions of supporters. In his

1931 book Direct Credits for Everybody,

he wrote:

Owing to the brightness and scarcity of

gold, as well as to its glittering appeal for childlike people, that metal was

principally used as money in the beginning, and eventually became the standard of money value throughout the world.

But the visible supply of gold in the

world could not keep pace with the ever increasing population who needed money

for trading purposes, and credit then came into vogue which permitted trade to

be carried on many times larger in amount than there was gold to pay for it.

And because there was not enough money

for everybody to use there were men who made it their business to get control

of it and make everybody pay for its use in the shape of interest.

No autocrat of any type ever held such

power over human beings as is held

by the present international financiers who control the supply of money. They

are the real masters of office holders, manufacturers, merchants and workmen.

And they are gradually screwing them all down to nothingness.

The branch of capitalism which allows

interest to be charged on money, has not only paralyzed mankind, but it is the

two-edged sword that will destroy Capitalism unless abolished at once.

And:

There is no end to this interest-paying

game. It is a series of circles running around within circles. It would require

a lifetime to explain, so that everybody could understand, how it keeps people

struggling for a pitiful existence; to explain how the money masters, who

produce nothing, are overloaded with wealth and power, while everybody, who

produces everything is reduced to beggary.

Capitalism can be made to work, yes, but

not before this undermining parasite called interest is exterminated.

To counter the iniquity of interest, he proposed that

everyone be given (by the government) a Direct Credit to be used to maximize

his or her potential – food, clothing, education, and so on. In this way, everyone would have a

chance to prosper, the poor would be fed and educated, and everyone’s talents

would have the potential to be realized.

If the credit is squandered, the person gets no more. If the credit is used wisely, the

person will be able to repay it.

If an entrepreneur wants to start a company, the government provides a

Direct Credit to each of the partners.

Again, if the credit is squandered, the participants can receive no

more. If successful, there will be

enough profit to repay the credit.

Lawson argues that it is interest that kills innovation and

often existence.

The system of Direct Credits will work

for everybody. It will give work to everybody, opportunities to everybody,

credit to everybody, money to everybody, nourishment to everybody, comforts to

everybody, education to everybody, character to everybody, intelligence to

everybody, and justice to everybody.

It will let Capital live in a clean way.

It will let Labor co-operate with Capital on a fair basis. It will make Capital

and Labor staunch friends who will work together in harmony for the benefit of everybody.

It will allow reasonable profits to the

manufacturers and merchants. It will give high wages to workmen so they can

purchase what they need from the merchants and utilize every useful thing made

by the manufacturers.

He also had strong views about inheritance:

To inherit a large fortune without having

done anything for it, is enough to make a lunatic of one, even if not one

before. And if it does not actually make a lunatic of him it will certainly do

him much harm in many ways.

The wealth of one generation is not the

wealth of a succeeding one. Each generation makes its own wealth, so that a

dead man's will is but an instrument to enslave following generations. Constant

labor is the only thing that makes wealth last.

It is easy to see why the Direct Credit Society had so many

followers, especially during the Great Depression. As the depression lessened, so did support for Lawson’s

ideas.

I like some of the parallels to today, and I’ve no doubt

that Lawson would have been part of the financial protests that sprung up

around the country recently.

Our forefathers

fought, bled and died that we could have the right to vote, but suffrage is

worthless to everybody if it is used to keep in power international financiers

who control 90 percent of the wealth produced by everybody.

At present if the government needs money

for improvements or other things, it borrows it and issues interest paying

bonds which are turned over to privateers for less money than the bonds call

for. The government is forced to do this, the same as individuals and

corporations, because there is not enough money in circulation to meet general

expenses.

In this manner the government is kept in

perpetual debt trying to pay the different interests upon the different bonds

that are forever accumulating.

It is estimated that the combined

municipal, state and national debts of the United States of America amount to

more than One Hundred Billion Dollars (1931). And if this compound

interest-paying scheme is kept up, the debts will increase to such an extent

that all of the wealth of the country will not be enough to pay them, and the

privateers who control the money can force the nation into bankruptcy in the

same way they do shopkeepers and manufacturers when they fail to pay the

interest, or, take away the home of the widow when she owes interest on the

mortgage.

In today’s political and economic environment, I could see

Lawson running for national office, with a large and rowdy following. I’d love to see his attack ads.

As I mentioned earlier, Lawson was also an educator and

scientist. Next time, I will

introduce you to the educational institution he founded – the humbly named University of Lawsonomy – and his theory

of the universe that everything can be described by the Law of Suction and Pressure,

and its corollary The Law of Zig-Zag-and-Swirl.

Stan - Thursday

Stan, this must be an August Fool's Day joke. Nobody could be that talented and accomplished. Except for you, of course.

ReplyDeleteJeff, wait until you read about the Laws of Suction and Pressure and the Zig-Zag-and-Swirl! And the University of Lawsonomy.

ReplyDeleteStan, I would not nominate Lawson for President. I don't think anyone as creative as he has held that post in 200 years. But I would LOVE to see him in Timonthy Geithner's job. A guy with that power who understood that banks should not rule the world might at least give the rest the people a fighting chance. We March-born babies tend to be passionate in our beliefs, I think. I look forward to the next installment!

ReplyDeleteLawson was the last person to make an effort to change our faulty financial system and that was 80 years ago. He understood that for Direct Credits to work it would require the elimination of selfishness and greed. Something this country still knows little about based on where we are now. People often make fun of things they don't understand. I don't see anyone able to prove he was ever wrong in what he was advocating. He was definitely a man ahead of his time.

ReplyDeleteI have recently found out That this great man is an ancestor of mine and am researching everything about him.

ReplyDelete