Jeff—Saturday

This threatens to be a sure-fire eye-glazer of a post, but

it’s the #1 question I’ve been asked on tour.

I’m the last person to field that question if you’re seeking investment

advice, yet it is encouraging that so many, in so many different parts of the

US, care enough to ask it.

By the way, my questioners aren’t Greeks. Perhaps that’s

because Greeks already know the answer; are among those so polarized in their political

views that they see the nation’s economic circumstances strictly through the

prism of party loyalty; or are so worn down by it all that they don’t want to

hear any more about it.

With that in mind, for purposes of reading this post I

suggest following the longstanding advice of Warren Buffett, and “put aside

personal politics when it comes to investment decisions.”

Let’s start with some of this week’s economic headlines on

the Greek economy.

“Spanish, Greek bonds

shine after ratings upgrades.”

“Approval of 3rd

review and release of tranche to Greece expected in Brussels.”

“Greek current account

deficit shrinks in November, tourism revenues rise.”

Looks promising, and certainly better than going in the

opposite direction. So, let’s look at what the headlines mean, starting at the

bottom and working up…which seems appropriate for the situation.

According to figures supplied by the Bank of Greece, in six

of the past eleven months Greece did better with its account deficit than it

did during comparable months the year before.

But, it’s a sawtooth type of graph, not straight-line growth, and improvement

is credited almost entirely to a decrease in the balance of goods, raising the

question of whether the shrinking deficit is because Greece sold more, or bought

less.

Surrounding the impending “final” 6.7 billion-euro bailout

tranche payment to Greece (5.7 in February and 1.0 in April) and official end

of the bailout program in August, there is a lot of talk over whether this

signals the beginning of the end or the end of the beginning to Greece’s fiscal

crisis. New taxes, and budget cuts demanded by Greece’s foreign creditors have

severely affected much of the country, and anxieties are running high over

what’s next to come. With elections in 2019

(if not sooner), there’s a plethora of suspicion (or a paucity of confidence,

if you prefer) in government promises and projections on what the future holds.

On the subject of bonds owed to creditors—not to be confused

with the sense of bondage many Greeks feel in service to foreign creditors—for

the first time in two years, Greek bonds have kicked up a notch in their

ratings! Hallelujah. But before anyone

starts passing out cigars, take note that Greece’s bonds are now rated ‘B’

according to S&P, while Spain—the other peripheral EU economy—was upped by

Fitch to ‘A-” despite its Catalan crisis. The news had yields for Greek short term and five-year

bonds falling (going down shows confidence in the bonds), but yields on its long-term

bonds actually went up slightly (yields on all of Spain’s bonds fell). Most analysts agree that the future for

Greece depends on how well it manages its exit from its bailout program. That’s

the sort of imponderable answer I feel most comfortable leaving for the gods to

sort out.

So, what other relevant news is out there this week

suggesting the true state of the Greek economy?

What caught my eye was an article analyzing unemployment figures

recently released by the Greek government. From the story’s headline, I think you’ll see the

direction in which the article is headed, but assuming the reporter’s figures

are correct (Anthee Carassava, reporting in DW.com), there’s a lot to reflect upon.

Here’s the headline, followed by relevant excerpts from the

article: “Greeks stuck in lousy,

part-time economy as government claims success.”

“Greece’s once record jobless rate of 27 percent may have

dropped seven points since the start of the financial crisis, but nearly six in

10 people are stuck in a market dominated by part-time on-and-off jobs.” [N.B. For those under 25-years-old, the youth

unemployment rate hovers at 40%]

“But worst of all, the gigs have demanded full-time work for

part-time terms of employment. ‘You’re hired for a weekly 15-hour

Friday-to-Saturday job and before you know it, your boss is calling you in,

forcing you to work Tuesdays, Wednesdays, and Thursdays without extra pay or

time off.’”

“In Greece, state statistics released this week show a

troubling trend: Six in 10 people are stuck in lousy, insecure part-time jobs. While the trend first exceeded the startling

50-percent mark last year, experts expected the figure to quickly recede as the

Greek economy, strangled by seven years of budget cuts and austerity reforms, grew

by nearly 2 percent. But it hasn’t, spelling what experts now call ‘hollowed

growth’ for a country struggling to claw out of the worst financial crisis ever

to hit a European Member state.”

“In the startling statistics released this week, five in 10

Greek workers are owed an average of six paychecks by exploitative employers

already paying part-time workers less than €500 [$600] a month.

Women, meantime receive 50 percent less.”

“With the government registering each person who works at

least two hours a week as employed…private labor groups and think tanks put the

real [jobless] figure around at least 25 percent.” [N.B. To be fair, for US statistical

unemployment rate purposes, one hour a week is considered employed, and the US

rate is currently 4.1% (8.9% youth)]

*****

Those figures—if accurate—are alarming. But what I see as perhaps the greatest threat

to Greece “getting to its feet” is reflected in the comment of a 26-year-old

female college graduate interviewed for the article: “You can sit and hope Greece plays catch-up, or you can pack up and

leave for a better future until then.”

I now have a question for my audience. Does anyone disagree with the proposition

that the greatest threat to a nation’s long-term growth and prosperity is the

loss of its industrious and entrepreneurial young to other lands? After all—and you can take it from me—it’s

hard to get back up on your feet relying on creaky old knees.

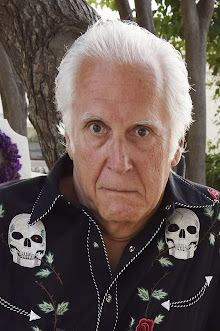

—Jeff

Jeff’s Upcoming Events

My ninth Chief Inspector Andreas Kaldis novel, AN AEGEAN APRIL, published on January 2,

2018, and here are the remaining stops on the first stage of my book tour:

Friday, February 2 @ 7PM

Centuries & Sleuths (Forest Park)

Chicago, IL

Saturday, February 3 @ 12 PM

Once Upon A Crime

Minneapolis, MN

Very well written, but very sad, column. No, things still don't look good for Greece, but I fear it won't be alone in the economic disaster ahead.

ReplyDeleteBTW, the ending photo of the knees are the bee's knees, my friend.

Thanks, EvKa. Yes, things are delicate and tricky in many parts of the world. It's as if everyone's plunging forward without even a glance at the rear view mirror for what's gaining momentum (again). By the way, my compliments on your choice of Vespidae. With the shorts, I was certain you were going for wasp's knees.

ReplyDelete